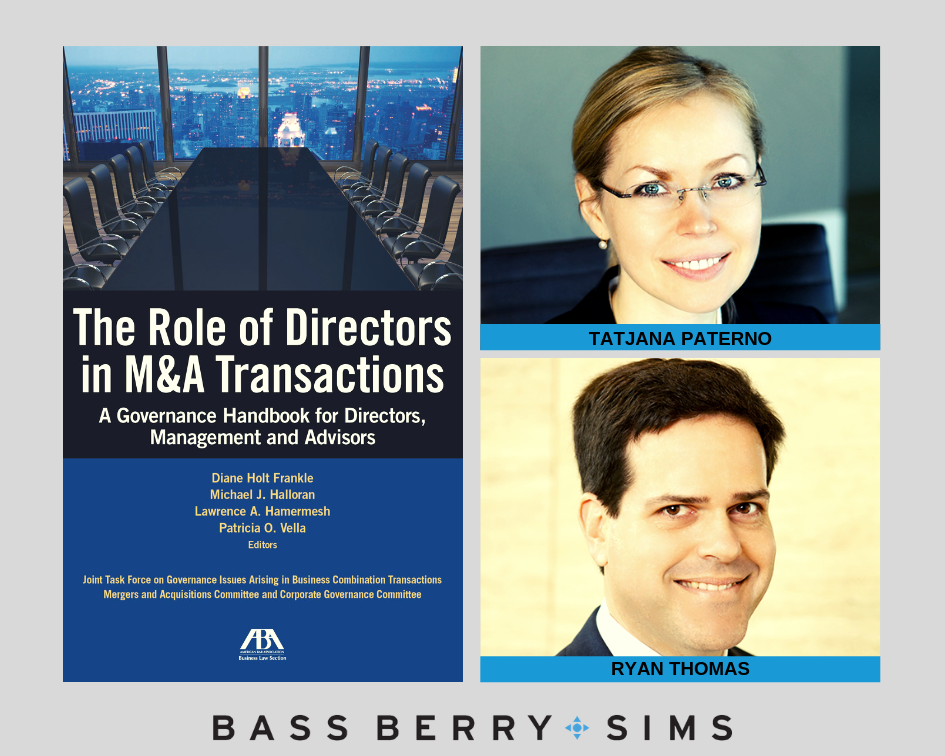

Bass, Berry & Sims attorneys Tatjana Paterno and Ryan Thomas were primary contributing authors to a chapter of the American Bar Association’s (ABA) The Role of Directors in M&A Transactions: A Governance Handbook for Directors, Management and Advisors. The chapter is titled, “Exploring Strategic Alternatives and Responding to Unsolicited Approaches—Starting the Process” that examines how a board can prepare for a potential transaction under different scenarios.

Bass, Berry & Sims attorneys Tatjana Paterno and Ryan Thomas were primary contributing authors to a chapter of the American Bar Association’s (ABA) The Role of Directors in M&A Transactions: A Governance Handbook for Directors, Management and Advisors. The chapter is titled, “Exploring Strategic Alternatives and Responding to Unsolicited Approaches—Starting the Process” that examines how a board can prepare for a potential transaction under different scenarios.

The guidebook project was instigated by Bass, Berry & Sims attorney Leigh Walton when she served as the chair of the ABA’s Mergers and Acquisition’s Committee, a group of over 4,500 leading M&A lawyers around the world. Leigh worked with the chair of the ABA’s Corporate Governance Committee to launch the project in 2011. Nearly eight years later, their foresight and unwavering leadership resulted in a practical guide that covers transactions for both public and private companies.

“This handbook should prove an invaluable resource to directors, bankers and other executives in the board room during a public sale process. Our chapter, in particular, brings to light, based in part on our real life boardroom and transactional experience, many of the practical and often nuanced and challenging considerations a board and management will face at the outset of a sale process, or upon receipt of an inbound inquiry. This book truly delivers a rare accomplishment in providing the kind of insight you can only typically learn by first-hand experience,” said Ryan.

The book examines the various governance issues related to M&A transactions, including:

- Key governance issues in M&A and the board’s central role in the M&A process

- Identifying and managing conflicts

- Exploring strategic alternatives, including preparing for a potential transaction and dealing with the pressure to sell

- Board process in engaging deal counsel and financial advisors, and key components of the sales process

- Negotiation of confidentiality and standstill agreements

- When and how to form a special committee

- The board’s continuing role after signing and before closing

“Our chapter includes a practical list of initial steps to take when preparing for a potential transaction, which could make a big difference in the process and help enhance the company’s value and marketability. We also discuss various ways that a company can be approached by unsolicited bidders and activist stockholders and what to expect in those situations – again, very practical insights,” said Tatjana.

Bass, Berry & Sims has a limited supply of complimentary books available. If you are interested in receiving a complimentary copy of the book, please contact Ryan, Tatjana or Leigh.

The Bass, Berry & Sims Corporate & Securities Practice encompasses mergers and acquisitions, capital markets transactions, corporate governance and shareholder activism. We serve as primary corporate and securities counsel to more than 35 public companies and have counseled on 150 deals ranging in size from $20 million to more than $15 billion over past two years. The team and our attorneys have been consistently recognized in leading industry outlets, including Chambers USA – ranked as a top corporate firm in Tennessee since 2003 – and M&A Advisor Award recipient for – “M&A Deal of the Year ($10MM-$25MM)” and “Healthcare and Life Sciences Deal of the Year (Over $100MM-$1B)” in 2018; and “M&A Deal of the Year (From $1B-$5B)” and “Corporate/Strategic Deal of the Year (Over $1B)” in 2017.