On August 29, the Centers for Medicare & Medicaid Services (CMS) published a list of the first ten drugs subject to negotiation under the new Medicare drug price negotiation program created by the Inflation Reduction Act (IRA) (see here for a summary of IRA provisions impacting pharmacies). The announcement is a major milestone in CMS’s implementation of the negotiation program and comes in the midst of several legal challenges against the program.

Absent any court decisions halting implementation, a negotiation period will now take place until August 1, 2024. CMS must publish maximum fair prices (MFPs) that will apply to the selected drugs by September 1, 2024, and the MFPs will go into effect for the selected drugs on January 1, 2026. The negotiation program will have significant financial and operational implications for pharmacies.

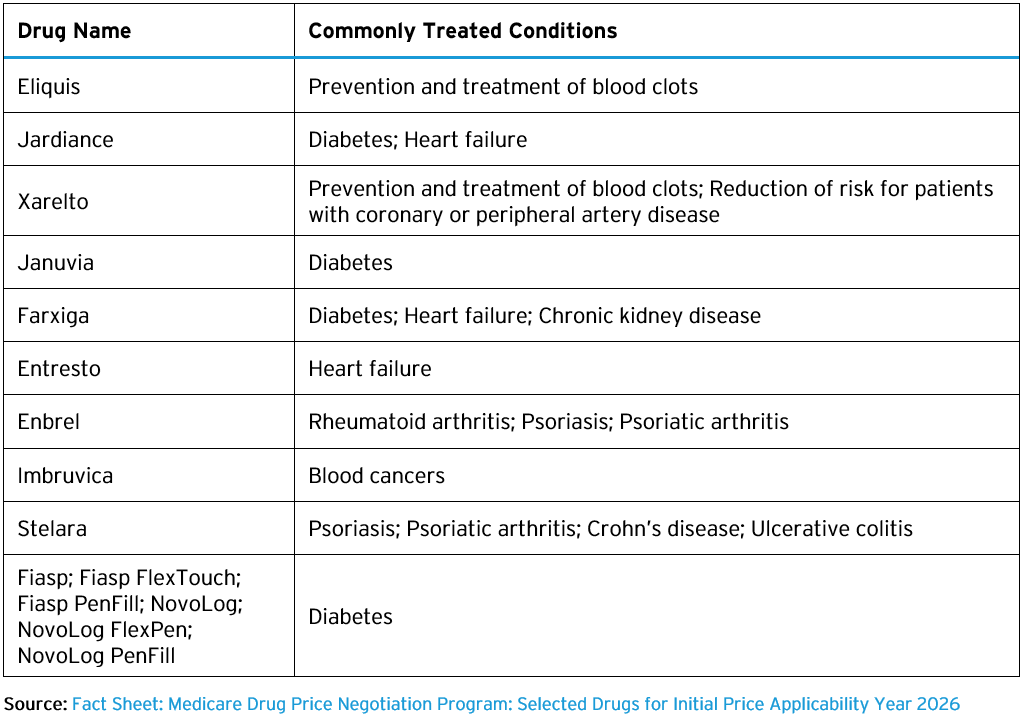

Drugs Selected for Negotiated Prices in 2026

CMS published a list of the ten drugs selected for negotiation in 2026 on CMS’s Medicare Drug Price Negotiation website. The list is available in both a fact sheet as well as a file that identifies the National Drug Codes (NDCs) associated with the selected drugs, totaling nearly 300 NDCs. The ten drugs and their commonly treated conditions are as follows:

Financial and Operational Considerations for Pharmacies

Pharmacies should review the list of drugs selected for negotiation to evaluate whether they are high-volume products. If so, changes in Medicare reimbursement for selected drugs are likely to have significant financial implications. Starting in 2026, Part D plans will reimburse pharmacies for selected drugs at no more than the drug’s MFP, plus a dispensing fee. The IRA did not address what the Part D dispensing fee will be and CMS has indicated Part D plans will set their own dispensing fees paid to pharmacies. Medicare will pay providers for selected Part B drugs at the MFP plus 6% instead of the current payment rate of average sales price (ASP) plus 6%. The MFP will be a percentage discount off a drug’s non-federal average manufacturer price (non-FAMP), ranging from a 25% discount to a 60% discount depending on how long a drug has been sold. As such, reimbursement rates based on the MFP will be substantially lower than current reimbursement rates.

As required by the IRA, CMS selected the ten drugs for 2026 from a list of drugs covered under Medicare Part D that account for the highest costs to Medicare. CMS will select an additional 15 Part D drugs for negotiation in 2027, and starting in 2028, CMS will select 15 additional drugs from a list of drugs covered under both Part D and Part B that account for the highest cost to Medicare. In 2029 and subsequent years, CMS will select an additional 20 drugs among the most costly Part D and Part B drugs.

Manufacturers will be required to provide pharmacies and providers with access to the MFP, ensuring that the price paid by a pharmacy or provider for a selected drug is no higher than the MFP. However, purchasing selected drugs at the MFP may leave only the Part D dispensing fee or the 6% of the MFP add-on under Part B as revenue. Pharmacies and providers would be left to negotiate deeper discounts with manufacturers to access greater revenues.

In June 2023, CMS issued negotiation program guidance that addressed how pharmacies will access the MFP in 2026. CMS will provide manufacturers with two options for providing pharmacies with access to the MFP, either through a prospective method of paying a price that is no greater than the MFP or through a retrospective reimbursement for the difference between the pharmacy’s acquisition cost and the MFP. Pharmacy stakeholders have urged CMS to require a standard refund amount based on a publicly available benchmark, such as wholesale acquisition cost (WAC), rather than basing the refund amount on the difference between the pharmacy’s purchase price and the MFP, which could allow pharmacies to retain a margin. CMS has indicated the agency is exploring such an option and will issue further guidance on how manufacturers should determine refund amounts to pharmacies.

CMS’s guidance also addressed operational steps pharmacies will need to take to be able to access the MFP for selected drugs, including the provision of data. CMS plans to use a third-party entity, referred to as a Medicare Transaction Facilitator (MTF), to help exchange data between pharmacies and other supply chain participants to demonstrate that the MFP is made available only with respect to selected drugs dispensed to Medicare beneficiaries. CMS is also evaluating options to identify selected drugs dispensed to Medicare beneficiaries that were purchased at 340B pricing to ensure manufacturers do not provide both a 340B discount and the MFP on the same drug. Drug manufacturers have urged CMS to require pharmacies to identify on Part D claims whether a drug was purchased at 340B pricing.

Status of Legal Challenges and Next Steps

To date, drug manufacturers and related organizations have brought eight lawsuits against CMS, challenging the legality of the negotiation program and CMS’s implementation. The lawsuits raise a number of legal questions, including whether the IRA violates the U.S. Constitution by imposing excessive fines without due process, compelling manufacturers to take actions in violation of free speech protections, and taking revenue from manufacturers in violation of the “takings” clause, among other arguments. The lawsuits have been filed in district courts located in six different circuits, creating the possibility of split decisions in different circuits, which could increase the likelihood of the challenges eventually reaching the U.S. Supreme Court.

Meanwhile, the plaintiffs in one of the cases, filed in the U.S. District Court for the Southern District of Ohio, have filed a motion for a preliminary injunction, asking the court to pause CMS’s implementation of the negotiation program before October 1, 2023, which is the date by when manufacturers of products selected for negotiation must sign negotiation agreements with the government. The government has opposed the motion, arguing the plaintiffs do not face imminent injury given that any potential financial injury would not begin until 2026. More requests for preliminary injunctions are likely, and stakeholders will be watching developments in these cases closely, as the issuance of a preliminary injunction would bring implementation of the negotiation program to a halt.

If implementation continues as CMS plans, manufacturers of the ten selected drugs must submit data to CMS by October 2, 2023, which CMS will use to generate initial offers of an MFP for each drug with a justification for the offer. CMS will send initial offers to manufacturers by February 1, 2024, at which point the negotiation period begins. Manufacturers will have 30 days to propose a counteroffer. The negotiation period will end on August 1, 2024, and CMS will publish MFPs by September 1, 2024. MFPs for the ten drugs will go into effect starting January 1, 2026.

We will continue to monitor developments related to the Medicare drug price negotiation program. Please contact the authors if you have any questions about the Medicare negotiation program or other provisions in the IRA.